Table of Contents

- Introduction

- Understanding Dollar Cost Averaging

- The Concept of Regular Investments

- Mitigating Market Volatility

- Long-Term Investment Benefits

- How to Implement Dollar Cost Averaging

- Choosing the Right Investments

- Monitoring and Adjusting Your Strategy

- Potential Risks and Considerations

- Dollar Cost Averaging vs. Lump Sum Investing

- Real-World Examples and Success Stories

- Common Misconceptions

- Expert Advice and Recommendations

- Conclusion

1. Introduction

Investing wisely is a goal shared by many, but navigating the unpredictable nature of financial markets can be daunting. Dollar Cost Averaging (DCA) is a strategy that offers a systematic and disciplined approach to investing, helping individuals manage market fluctuations and build wealth over time. This comprehensive guide explores the concept of Dollar Cost Averaging, its benefits, implementation strategies, and real-world examples.

2. Understanding Dollar Cost Averaging

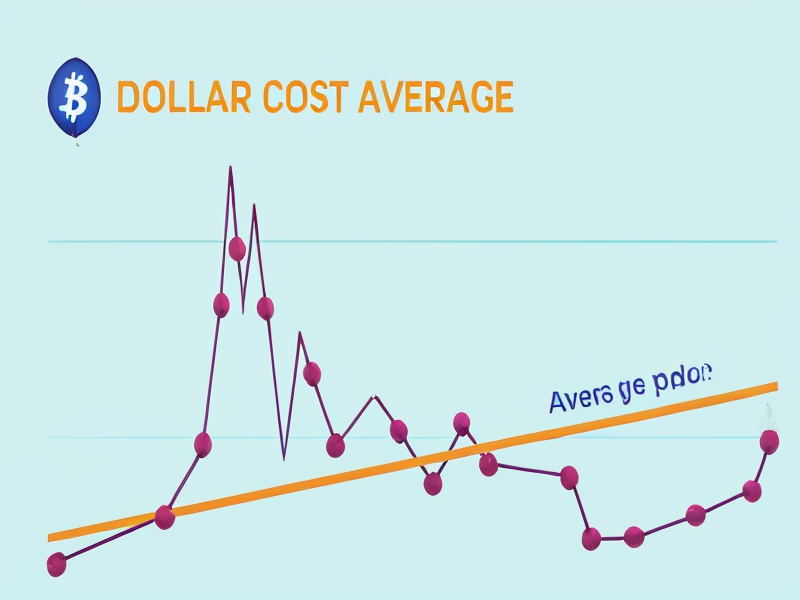

Dollar Cost Averaging is an investment strategy that involves consistently investing a fixed amount of money at regular intervals, regardless of market conditions. This section provides a foundational understanding of DCA, emphasizing its core principles and how it differs from lump sum investing. DCA is designed to reduce the impact of market volatility on investment returns.

3. The Concept of Regular Investments

Central to Dollar Cost Averaging is the concept of making regular investments. This section delves into the rationale behind consistently contributing to investments over time. By spreading investments across different market conditions, investors can benefit from both highs and lows, potentially reducing the impact of market timing.

4. Mitigating Market Volatility

One of the key advantages of Dollar Cost Averaging is its ability to mitigate the impact of market volatility. This section explores how DCA allows investors to buy more shares when prices are low and fewer shares when prices are high. The result is a lower average cost per share over time, potentially leading to better overall returns.

5. Long-Term Investment Benefits

Dollar Cost Averaging is particularly well-suited for long-term investors. This section discusses the benefits of adopting a patient and disciplined approach to investing. By staying committed to regular contributions, investors can harness the power of compounding and benefit from the potential growth of their investments over an extended period.

6. How to Implement Dollar Cost Averaging

Implementing Dollar Cost Averaging involves a straightforward process. This section provides practical steps for investors to initiate and maintain a DCA strategy. From setting a fixed investment amount to choosing the right frequency, the guide offers actionable insights to help investors get started on their DCA journey.

7. Choosing the Right Investments

Selecting the right investments is crucial for the success of any investment strategy, including Dollar Cost Averaging. This section explores considerations for choosing suitable assets, whether it be individual stocks, exchange-traded funds (ETFs), or mutual funds. Diversification and aligning investments with long-term goals are key principles in this decision-making process.

8. Monitoring and Adjusting Your Strategy

Regularly monitoring and, if necessary, adjusting your Dollar Cost Averaging strategy is essential. This section provides guidance on evaluating the performance of your investments, making informed adjustments based on changing circumstances, and staying aligned with your financial goals.

9. Potential Risks and Considerations

While Dollar Cost Averaging is a sound investment strategy, it’s important to be aware of potential risks and considerations. This section discusses factors such as transaction costs, the impact of fees, and the need for a long-term perspective. Understanding these considerations allows investors to make informed decisions about their investment strategy.

10. Dollar Cost Averaging vs. Lump Sum Investing

Comparing Dollar Cost Averaging with lump sum investing is a common consideration for investors. This section explores the differences between the two approaches, highlighting the benefits and potential drawbacks of each. Understanding the contrasts helps investors make informed choices based on their risk tolerance and financial objectives.

11. Real-World Examples and Success Stories

Real-world examples and success stories provide valuable insights into the effectiveness of Dollar Cost Averaging. This section features case studies of individuals or scenarios where DCA has led to positive outcomes. Examining these practical examples reinforces the principles and benefits of this investment strategy.

12. Common Misconceptions

Addressing common misconceptions about Dollar Cost Averaging is crucial for clarity. This section dispels myths and misunderstandings surrounding DCA, providing accurate information to empower investors in making informed decisions about their financial future.

13. Expert Advice and Recommendations

Seeking expert advice is a prudent step in any investment strategy. This section gathers insights and recommendations from financial experts, offering additional perspectives on the benefits, risks, and best practices associated with Dollar Cost Averaging.

14. Conclusion

Dollar Cost Averaging is a powerful strategy that empowers investors to navigate market volatility and build wealth over time. This comprehensive guide has equipped you with the knowledge and tools to understand, implement, and optimize your DCA strategy. As you embark on your investment journey, remember that consistency, discipline, and a long-term perspective are key principles in maximizing returns and achieving financial success.